lakewood co sales tax return form

The distributor does not collect any sales tax. The PIF is a fee and NOT a tax.

How To Organize Your Receipts For Tax Time Visual Ly Small Business Tax Tax Time Business Tax

Chat with a Business Tax Advisor Now.

. See If You Qualify and File Today. The Division of Tax is located at 12805 Detroit Ave Suite One. Enter the applicable state city county or special district tax rate in each column of the return.

TAX AMOUNT DUE PENALTY IF PAID AFTER DUE DATE INTEREST IF PAID AFTER THE DUE DATE 5. Therefore it becomes a part of the overall cost of the saleservice and is subject to sales tax Examples of these improvements include curbs and sidewalks. Sales Use Tax Forms Instructions Retail Sales Tax CR 0100 - Sales Tax and Withholding Account Application DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR.

The City of Lakewood receives 1 of the. Get Access to the Largest Online Library of Legal Forms for Any State. After you create your own User ID and Password for the income tax account you may file a return.

Note that in some retail areas of the City a. File sales tax faster with Avalara Returns for Small Business. Risk Free for 60 Days.

Ad Automate sales tax returns with our low cost solution built for mulit-channel sellers. Find Reliable Business Tax Info Online in Minutes. Certificate of Taxes Due PDF 112KB Engaged in Business in the City PDF 589KB Qualified Hospital Organizations PDF 218KB Sale or Purchase of a Business PDF 95KB Tax Exempt.

15 or less per month. CITY OF LAKEWOOD COLORADO MISCELLANEOUS SALES TAX REPORTING FORM 2. Lakewood OH 44107 216 521-7580.

The Lakewood Municipal Code imposes a use tax of 3 for the privilege of using storing distributing or otherwise consuming tangible personal property or taxable services inside the. Ad Download Or Email CO DR 0100 More Fillable Forms Register and Subscribe Now. City Income Tax Return for Individuals.

Annual returns are due January 20. This is the total of state county and city sales tax. Lakewood Business Pro Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division.

The minimum combined 2022 sales tax rate for Lakewood Colorado is. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. Form Instructions In preparing a.

Complete Edit or Print Tax Forms Instantly. The Belmar Business areas tax rate is 1. Colorado Retail Sales Tax Return DR 0100 092721 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0013 TaxColoradogov DONOTSEND.

Total sales tax collected. REVENUE DIVISION PO BOX 17479 DENVER CO 80217 Letter. File sales tax faster with Avalara Returns for Small Business.

Sales Tax Rates With the exception of the Belmar Business area the sales tax for Lakewood is 3. Ad The Leading Online Publisher of Colorado-specific Legal Documents. Integrate Vertex seamlessly to the systems you already use.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Sales tax returns may be filed annually. The ST3 sales and use tax rate of 050 is effective April 1 2017 bringing the total sales and use tax rate for Sound Transit to 140.

Ad Download Or Email CO DR 0100 More Fillable Forms Register and Subscribe Now. Businesses with a sales tax liability of up to 15month or 180year. The current total local sales tax rate in Lakewood CO is 7500.

The December 2020 total local sales tax rate was also 7500. Get Tax Lein Info You Can Trust. Complete Edit or Print Tax Forms Instantly.

Ad Ask Independently Verified Business Tax CPAs Online. City of lakewood salesuse tax return period. Bad debts collected.

Ad Automate sales tax returns with our low cost solution built for mulit-channel sellers. File Sales Tax Online There are a few ways to e-file sales tax returns. Risk Free for 60 Days.

The sales tax rates for each city county and special. Gross sales and service 2a. The Colorado state sales tax rate is 29.

Ad File For Free With TurboTax Free Edition. Get rates tables What is the sales tax rate in Lakewood Colorado. Filing frequency is determined by the amount of sales tax collected monthly.

Add lines 5a 5b line 6 8.

Washington Sales Tax Guide For Businesses

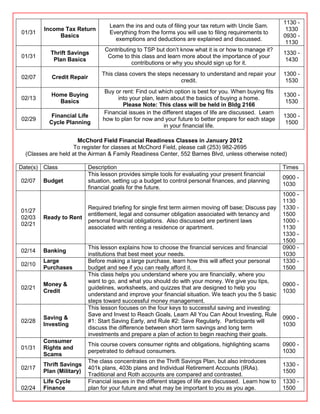

Business Tax Classes Department Of Revenue Taxation

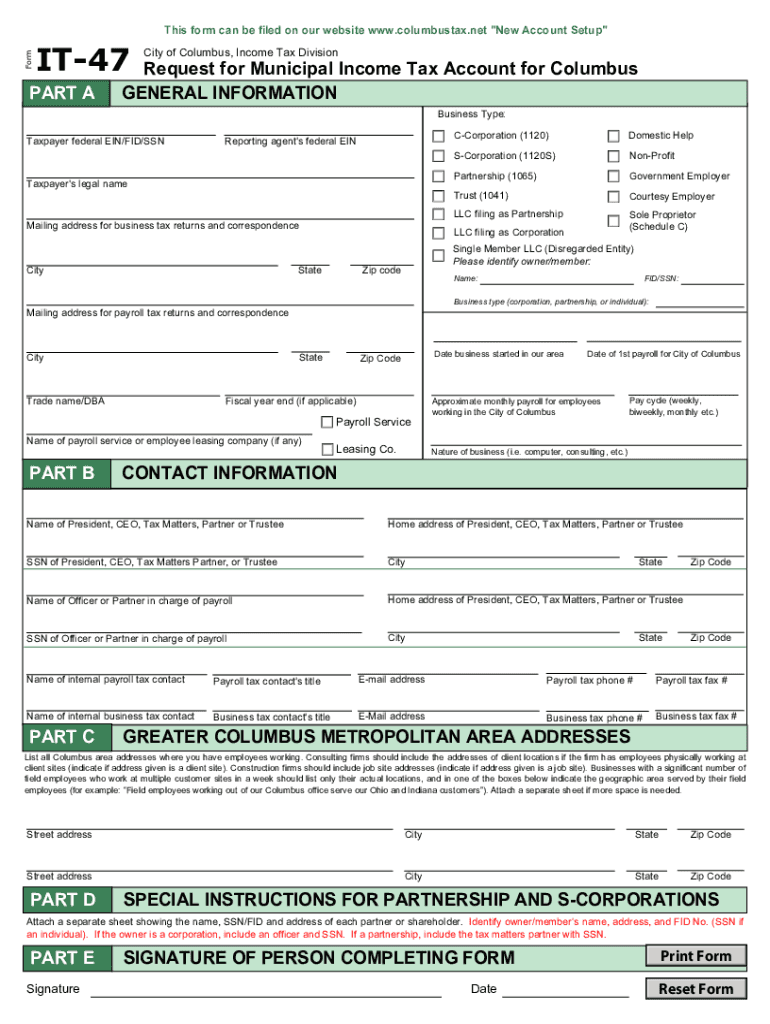

Oh It 47 Columbus City 2020 2022 Fill Out Tax Template Online Us Legal Forms

8 Business Profile Templates Word Excel Pdf Templates Company Profile Template Business Profile Company Profile

Account Id And Letter Id Locations Washington Department Of Revenue

Colorado Bookkeeping Businesses For Sale Buy Colorado Bookkeeping Businesses At Bizquest

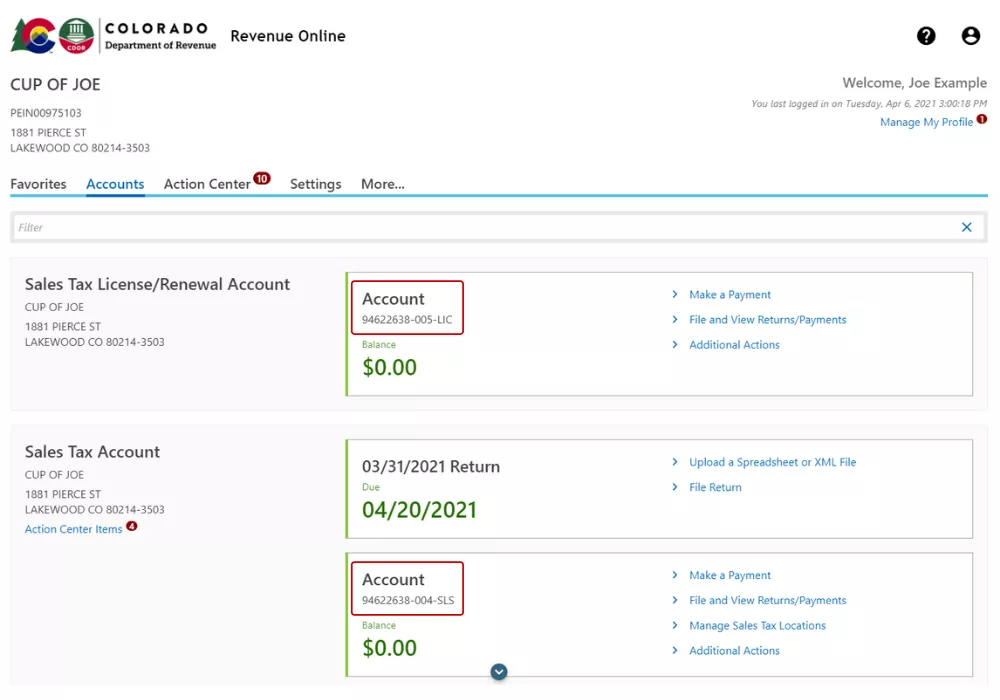

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Tax Flyer Payroll Accounting Services Tax Services

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Colorado Bookkeeping Businesses For Sale Buy Colorado Bookkeeping Businesses At Bizquest

Business Tax Classes Department Of Revenue Taxation

Sales Use Tax System Suts Department Of Revenue Taxation

Washington Sales Tax Guide For Businesses

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Washington Sales Tax Guide For Businesses

Dragonslayer Weekly Update 27 Jan 12

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation